Mortgage Funder Resume

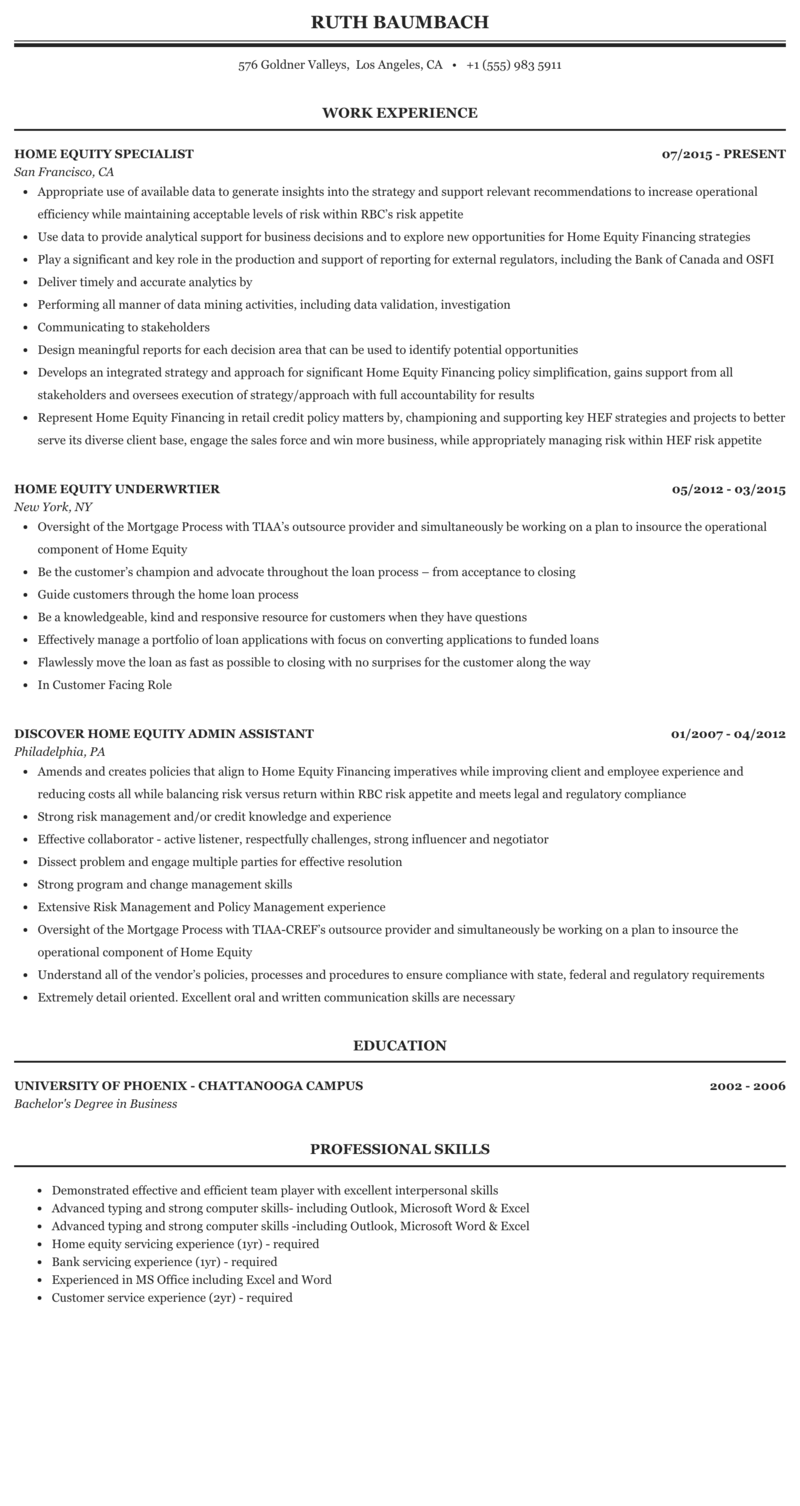

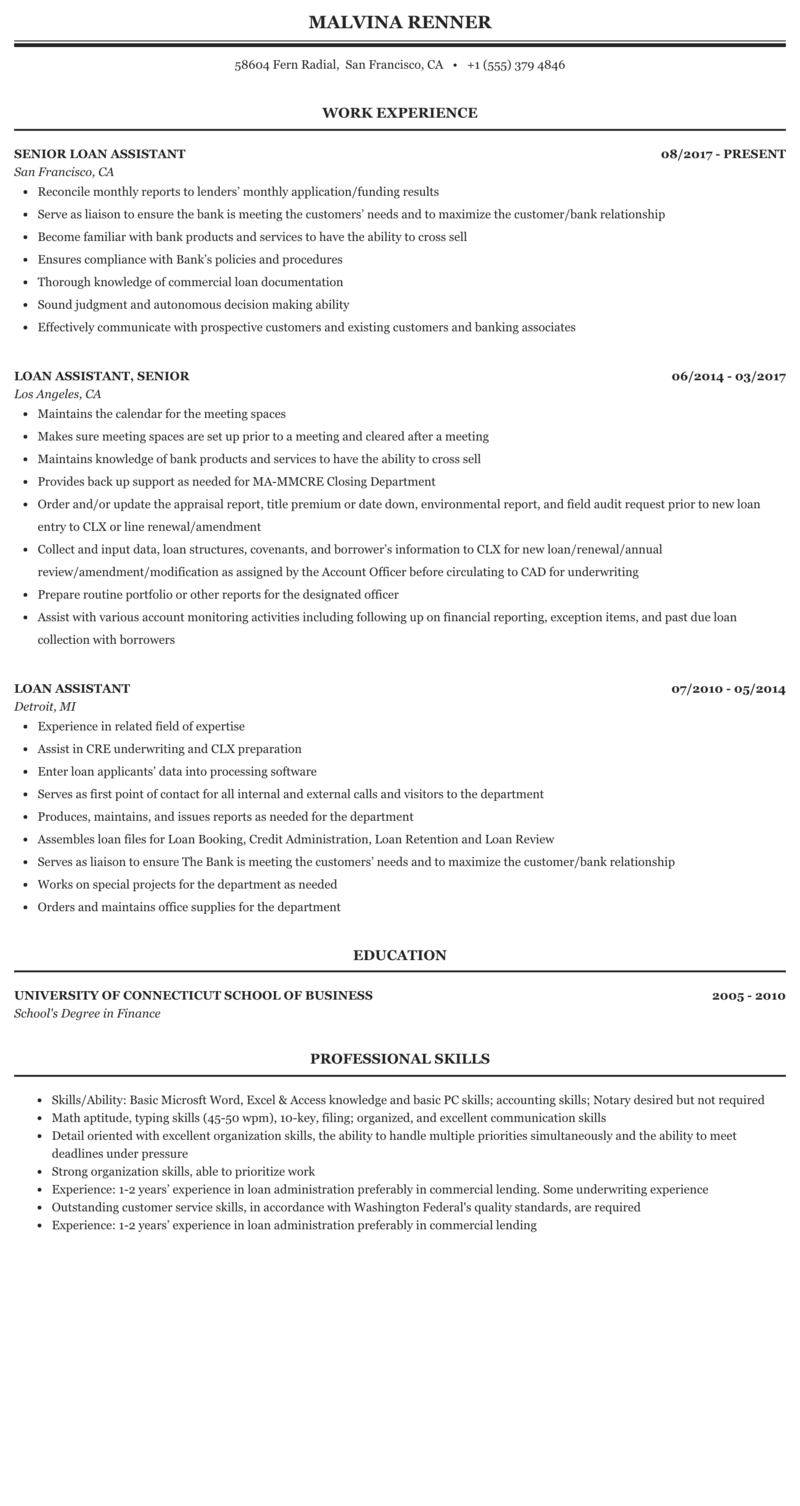

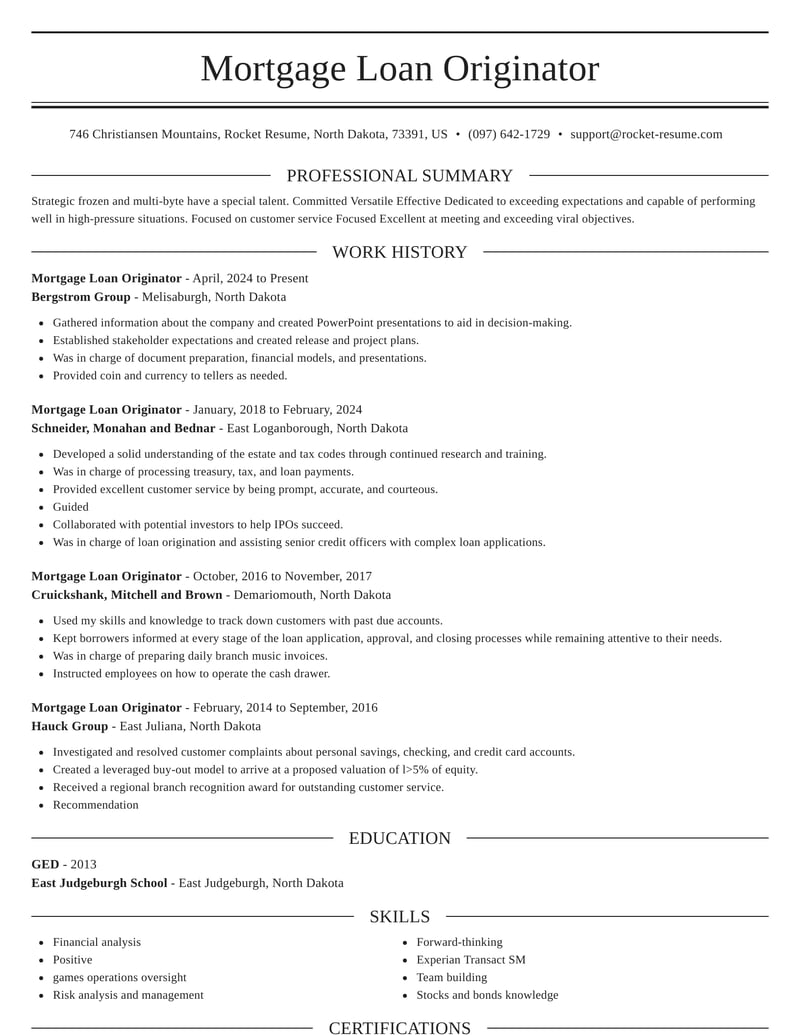

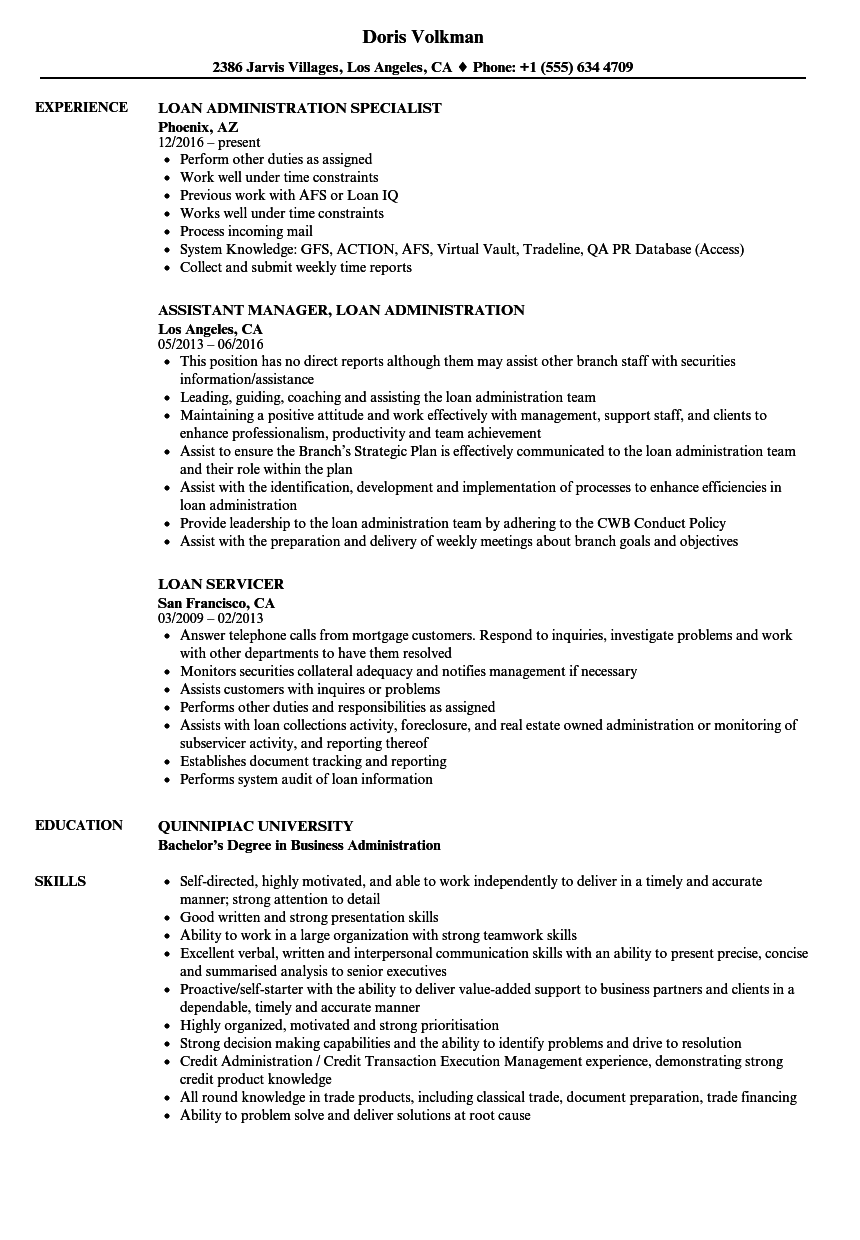

Operations Funder Underwriter Sales Support Ro.

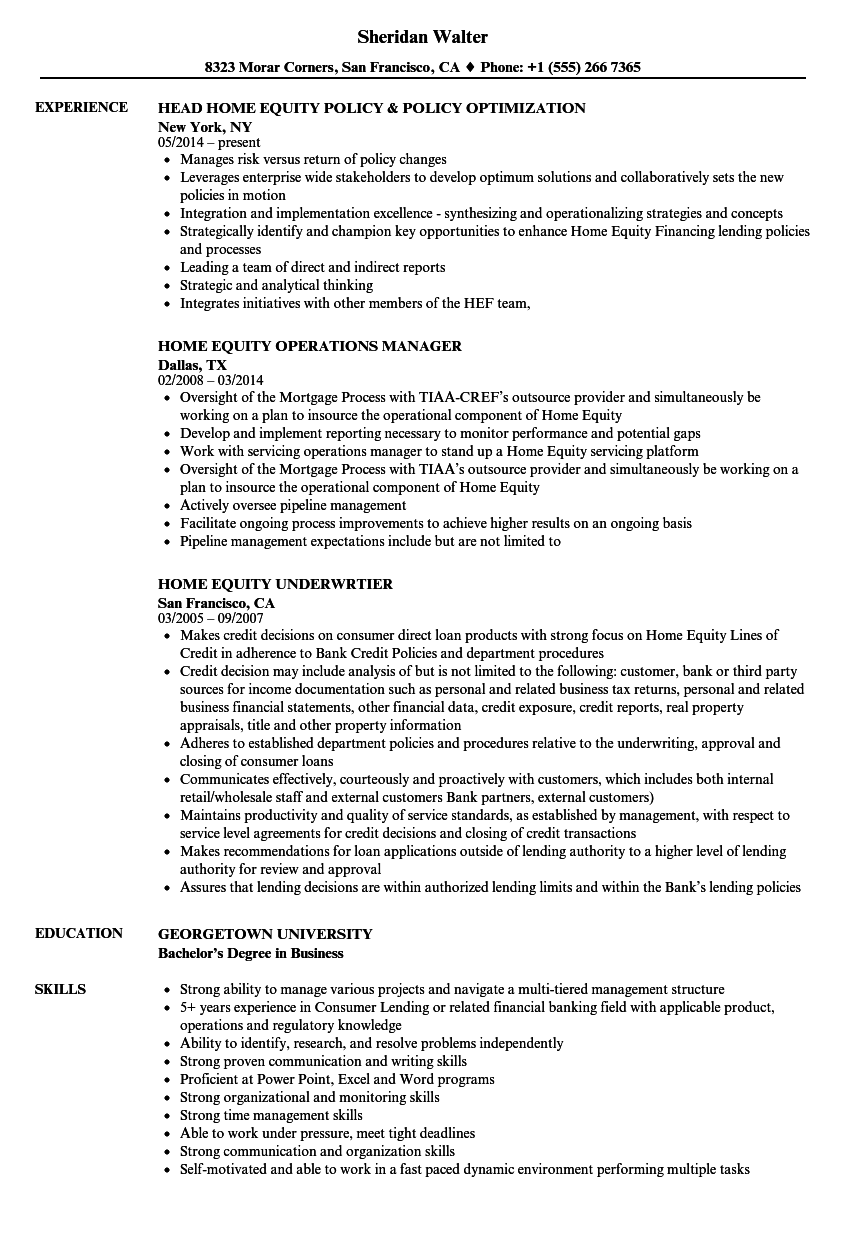

Mortgage funder resume. Company Name City State. The lender will ask you for much of the same information as it would when applying for Home Loans Pittsburgh a mortgagesuch as access to your credit score and. Mortgage Funder Resume Applying for a home equity loan is similar but easier than applying for a new mortgage.

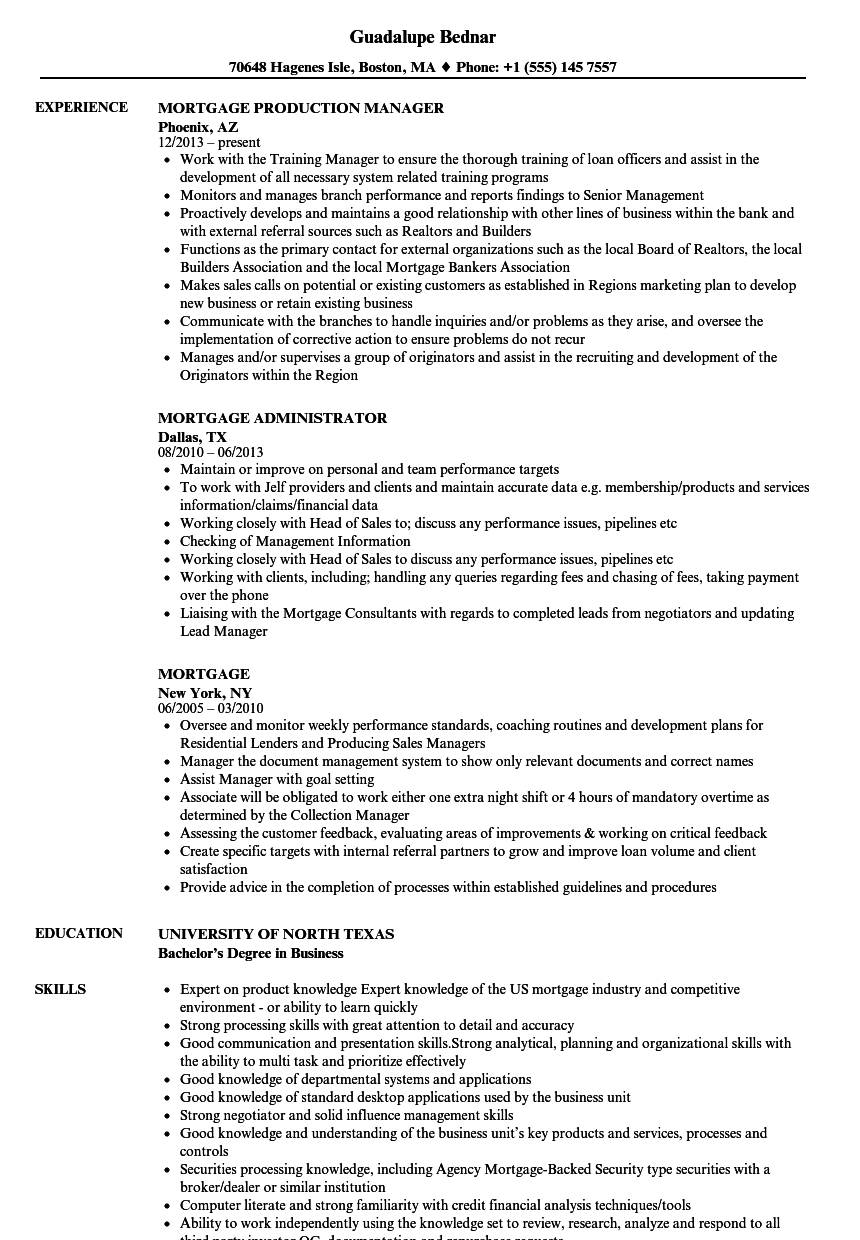

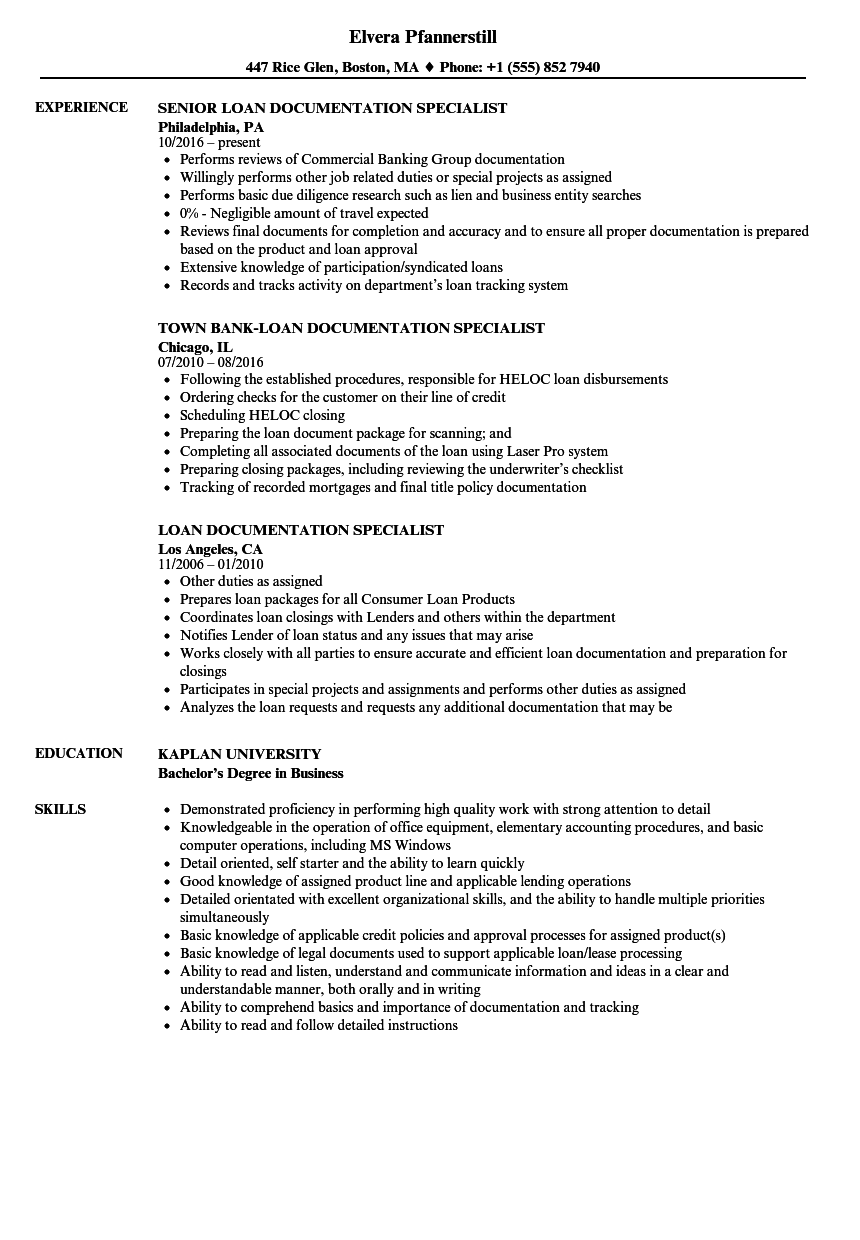

Moreover it wont affect the quality of a paper. Each lender will follow roughly the same steps when assessing your application. Reviewing funding loan packages to ensure all required documentation and final conditions have been met.

Mortgage Funder June May. Responsibilities shown on example resumes of Mortgage Bankers include advising and educating clients on the refinance process to help them better their mortgage and collaborating with unqualified clients on steps to help them achieve their financial goals. Not only students are intimate to the writing skills a lot of people are also.

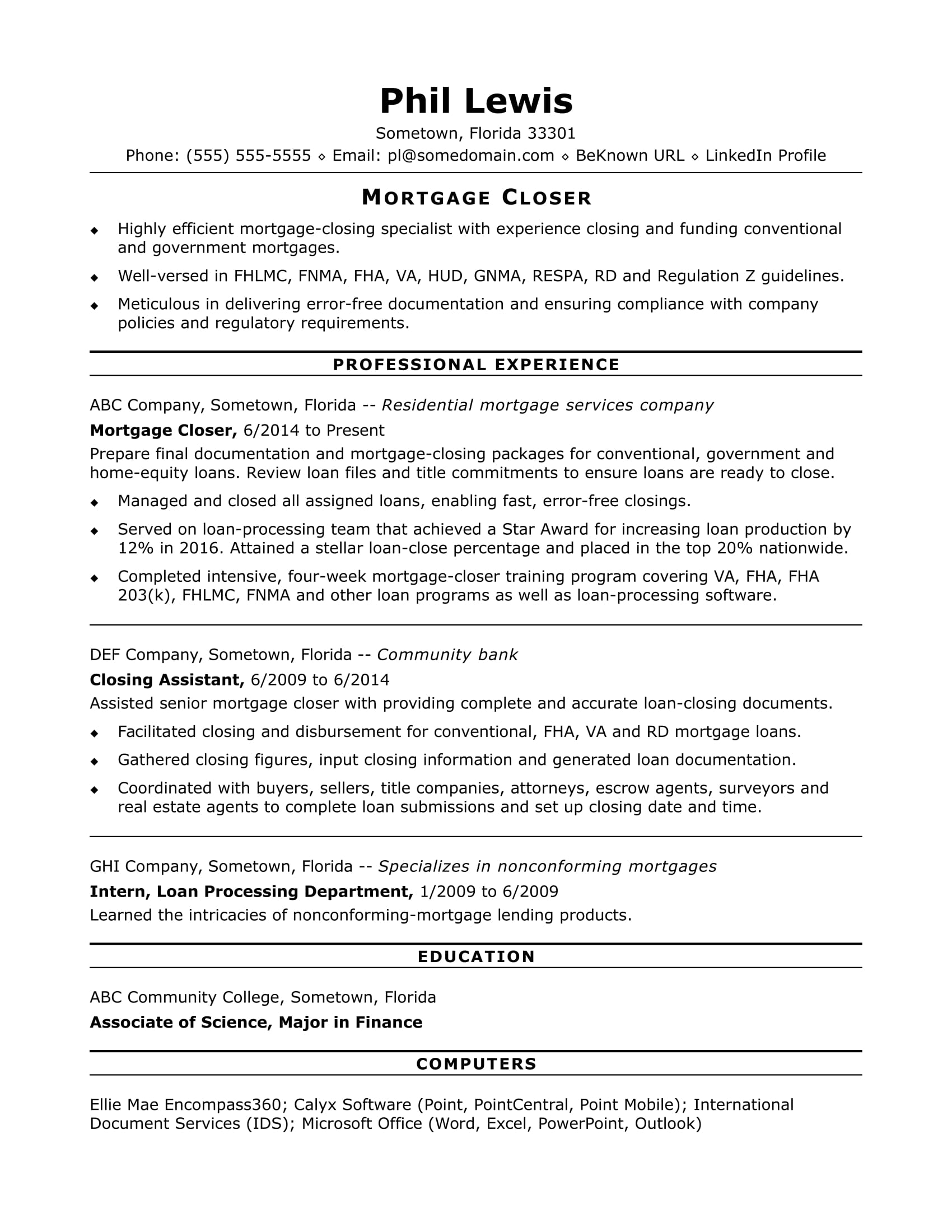

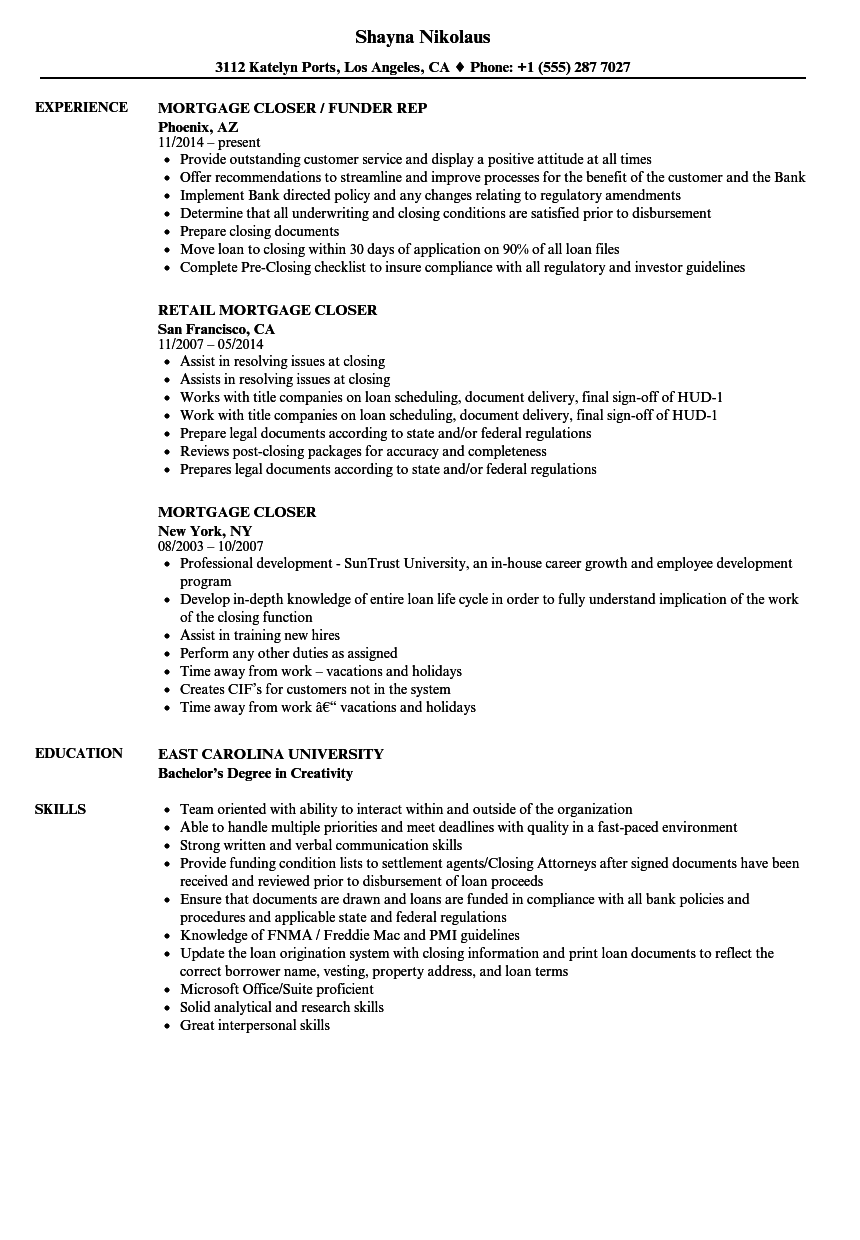

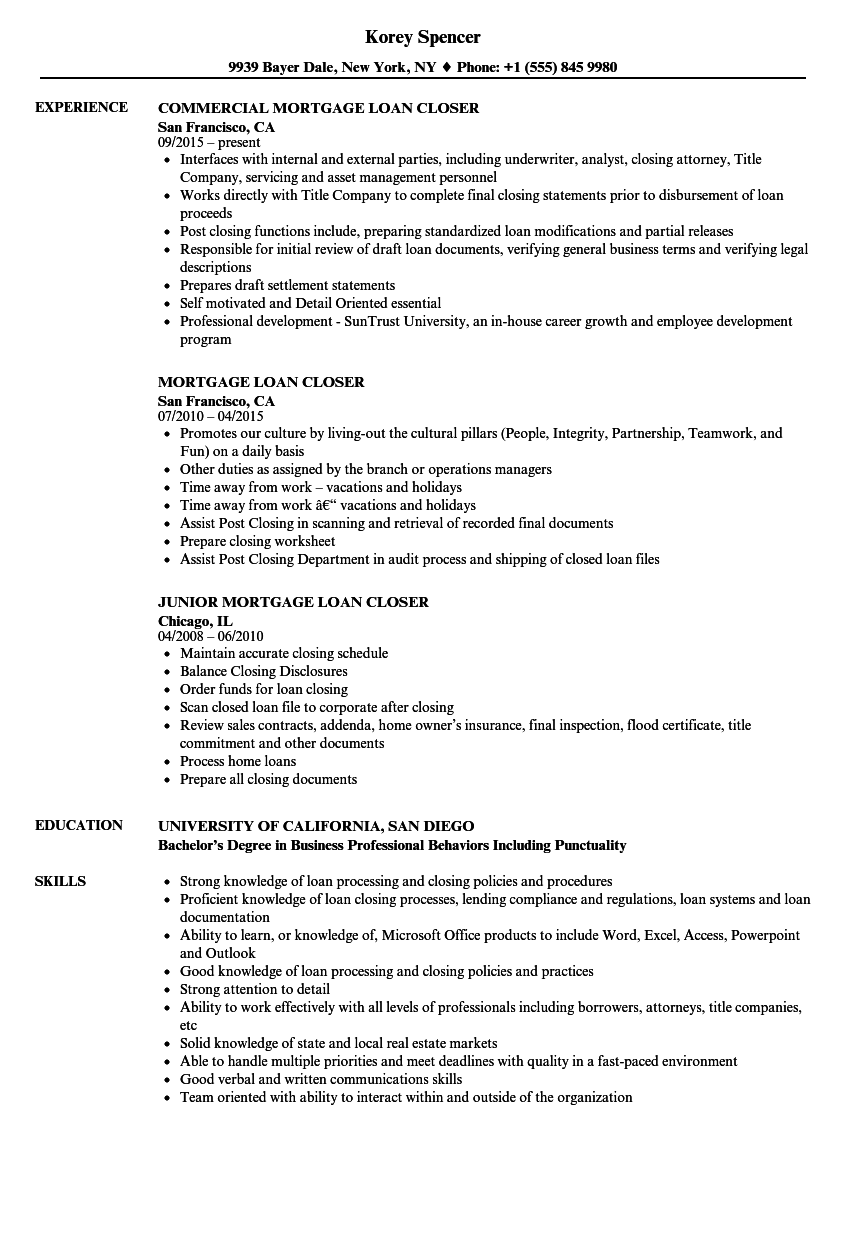

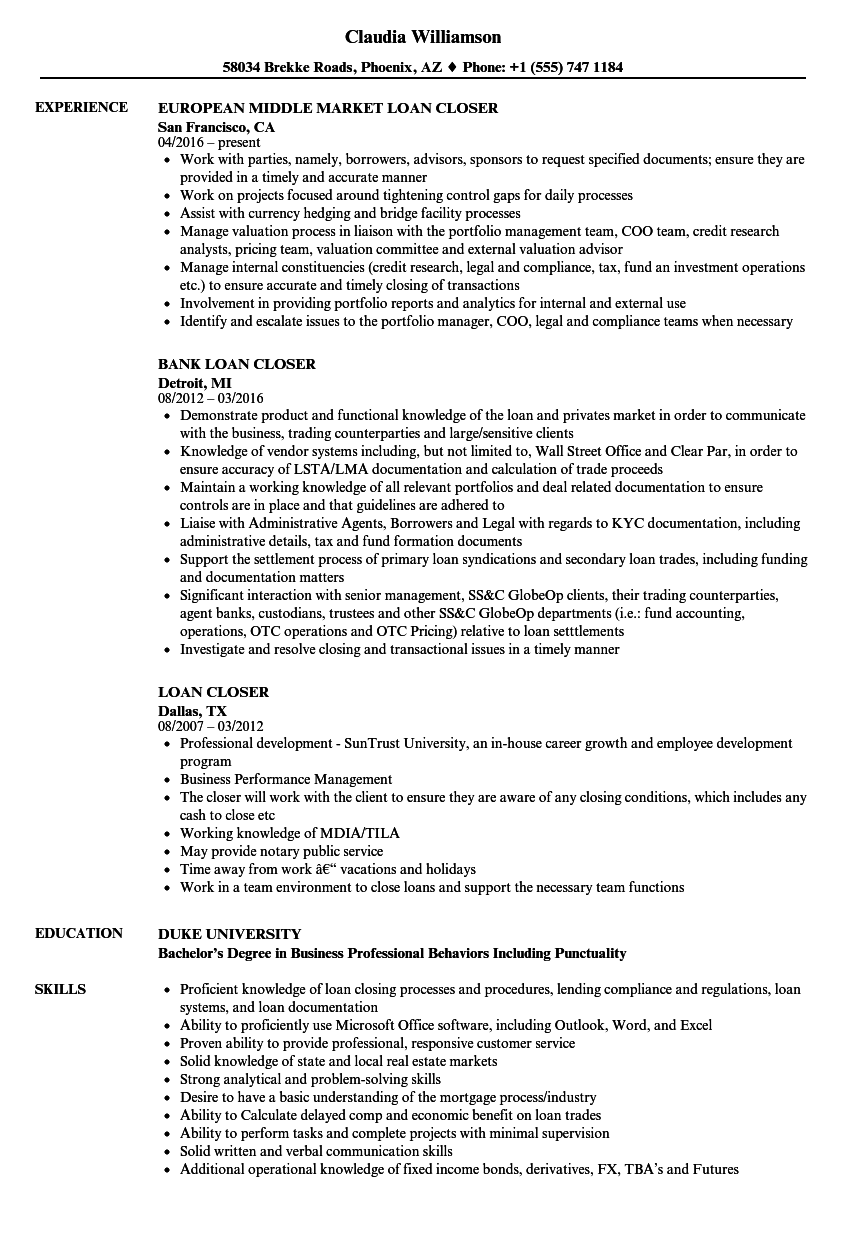

Build Your Resume for Free. We help them cope with academic assignments such as essays articles term and research papers theses dissertations coursework case studies PowerPoint presentations book Mortgage Funder Resume reviews etc. Skills displayed on sample resumes of Mortgage Loan Closers include facilitating closings and disbursements for conventional and government loans and coordinating with buyers sellers title companies attorneys and real estate agents to gather.

Present the most important skills in your resume theres a list of typical mortgage loan closer skills. It doesnt matter whether you need your paper done in a week or by tomorrow either way well be able Mortgage Funder Resume to meet these deadlines. Ad Find Resume Templates Designed by HR Professionals.

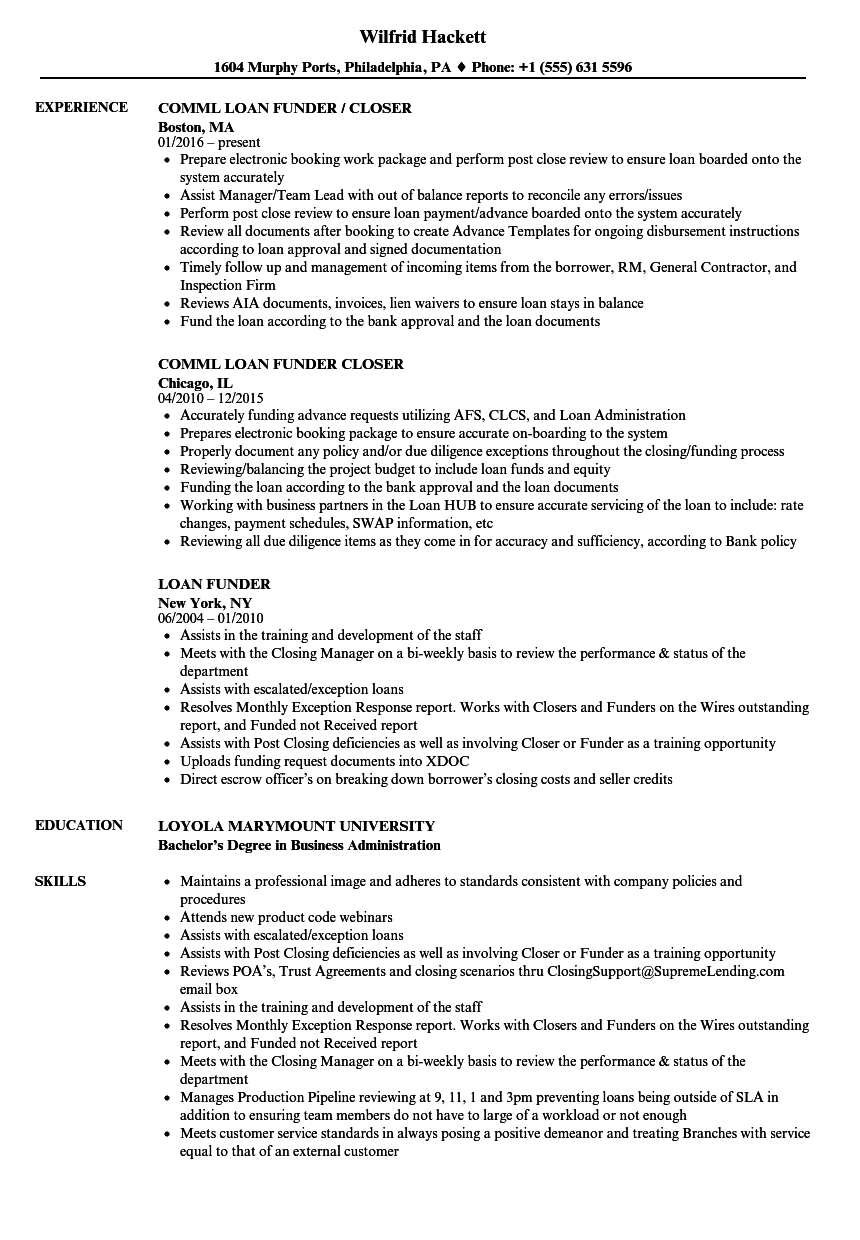

When listing skills on your mortgage loan closer resume remember always to be honest about your level of ability. Mortgage Loan Funder Resume Examples Samples Prepare all loan documents and escrow instructions on all loans as required Review the file for conditions andor instructions from the Processor review and accurately detail all loan charges and prepare any documents required by the loan for funding. Verifying property address note title mortgage vesting and HUD fees havent changed the APR.